Dode Seidu, Dean and Chief Executive, Africa Trade Academy

A. Introduction and Context

This article dissects the multifaceted complexities affecting Africa and African businesses in global trade, their impact and how the continent and businesses could turn these challenges into growth-enhancing opportunities.

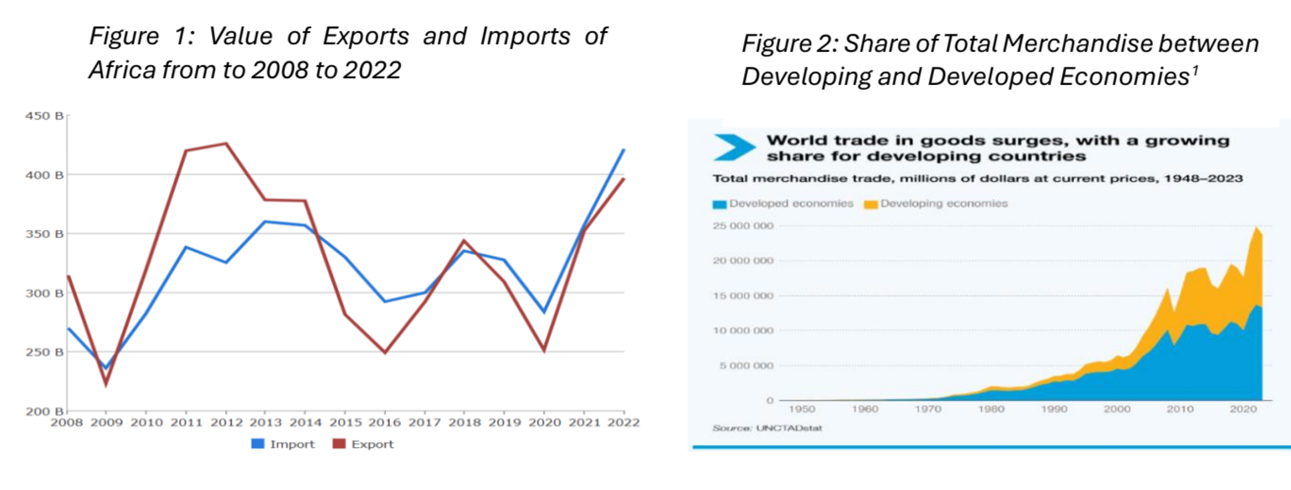

Global trade reached a record $33 trillion in 2024, growing by 3.7% ($1.2 trillion) from 2023.1 The WTO also notes a remarkable expansion, with world trade volume today approximately 45 times higher than the level recorded in the early days of GATT (4500% growth from 1950 to 2024).2 Additionally, participation of developing economies in global trade has witnessed faster growth than developed economies with Africa experiencing 4% increase in imports and exports compared to 2% for developed countries (see Figure 2), and accounted for about 44% of world merchandise trade in 2023 as seen in Figure 1 and 2 .3

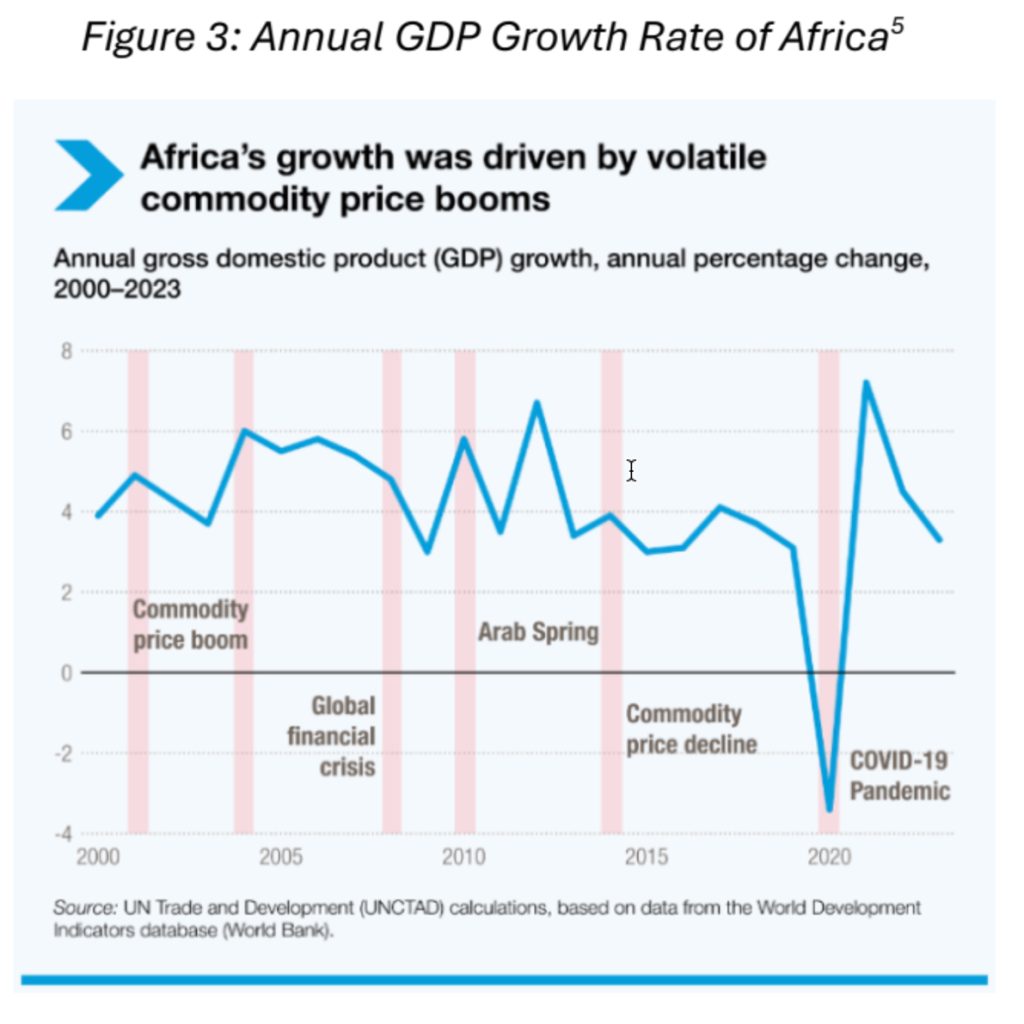

Gross Domestic Product (GDP) growth of Africa between 2000–2023 has been declining (see Figure 3) as growth slowed to 3.1% between 2011 and 2020 (but still above the global average of 2.4%), after growing by 4.8% annually, outpacing the global average of 3.1% from 2000 to 2010. 4 Africa’s trade growth was closely tied to commodity price booms with more than 50% of African nations drawing 60% of export earnings from crude oil, gas or minerals making these continent’s growth subject to commodity and supply chain shocks. Major among these shocks that worsened these vulnerabilities are the 2014 commodity price downturn and the COVID-19 pandemic from 2020. The 2014 commodity price downturn and the COVID-19 pandemic highlighted these vulnerabilities and accounts for the decline in the growth rate.

Intra-African trade rose to $192.2 billion in 2023, a 3.2% increase from 2022 with Africa playing a leading role despite a decline in share of world trade.6 The 2024 Africa Economic Outlook by the AfDB forecasted economic growth in Africa to edge up from 3.3% in 2024 to 3.5% in 2025, showing some resilience, despite uncertainty in the global economy and restricted fiscal space. With successful implementation of the AfCFTA Agreement, Africa’s economy is expected to increase US$29 trillion by 2050 and to boost intra-Africa trade by 52.3 percent by eliminating import duties. Digital economy is projected to reach $180 billion by 2025, up from $115 billion in 2020 with AfCFTA. 7

B. Global Trade Complexities

The 2024 Global Trade Report by Thomson Reuters Institute identified six key factors contributing to global trade complexities: supply chain disruptions; economic uncertainty; environmental social and governance; international politics and conflicts; technological developments; and regulatory compliance.8

Supply chain disruptions, which is a frequent contributor to global trade complexities, could be a result of one-off (earthquakes) or recurrent natural disasters (hurricanes), or man-made factors such as port workers strikes or shortages in shipping containers.9

Economic uncertainties, resulting from economic downturns and booms, contribute to global trade complexities by making it difficult to accurately forecast demand and supply patterns, affecting supply chain planning.10

Environment, social and governance (ESG) changes continue to evolve from being largely driven by shareholder and customer pressures or reputational and corporate values considerations towards formal regulatory, legal, and accounting frameworks. Major trading nations are increasingly adopting laws restricting or prohibiting trade in goods that are not manufactured or produced according to emerging environmental, labor, and human rights standards, as well as mandating corporate ESG reporting. These increasing ESG requirements are becoming major considerations by significant customers (e.g. EU Deforestation Regulations by EU buyers) and investors and is becoming a critical aspect of managing reputational risk in global supply chains.11

International politics and conflicts including trade disputes (US-China), tariffs (US and major trading partners and conflicts (Russia-Ukraine), also contribute to global trade complexities, having far reaching impacts on countries and supply chains. Their impact affects how and where to source raw materials, while navigating uncertain and unclear trade rules and tensions as well as deciding supply chain routes to avoid conflict zones.12

Technology adoption is adding complexities to global trade as the relatively slow rate of adoption of technology is impacting businesses supply chains. While businesses are using technology to increase their efficiency and competitiveness through the development and delivery of innovative products and services, hence driving investments in technology and innovation. For supply chain management, businesses are enhancing security and visibility and trade compliance through technology adoption.13 However, the lack of end-to-end supply chain management technology within and among firms and their supply chain actors is affecting the effectiveness of of these technologies.14

Regulatory compliance, arising from multiple and varying trade and related regulations in multiple jurisdictions, contributes to global trade complexities. Emerging topics such as e-commerce and digital trade, environment, social and governance, customs procedures etc., are adding to the complexity of monitoring and management regulatory developments across supply chain.15 The key challenge has been to keep up to date and to be in compliance with the regulatory requirements.

Each of these factors outlined do not only add complexities to international trade but also requires a complexity of tools and approaches to navigate.

C. Global Shocks Affecting Africa Since 2020

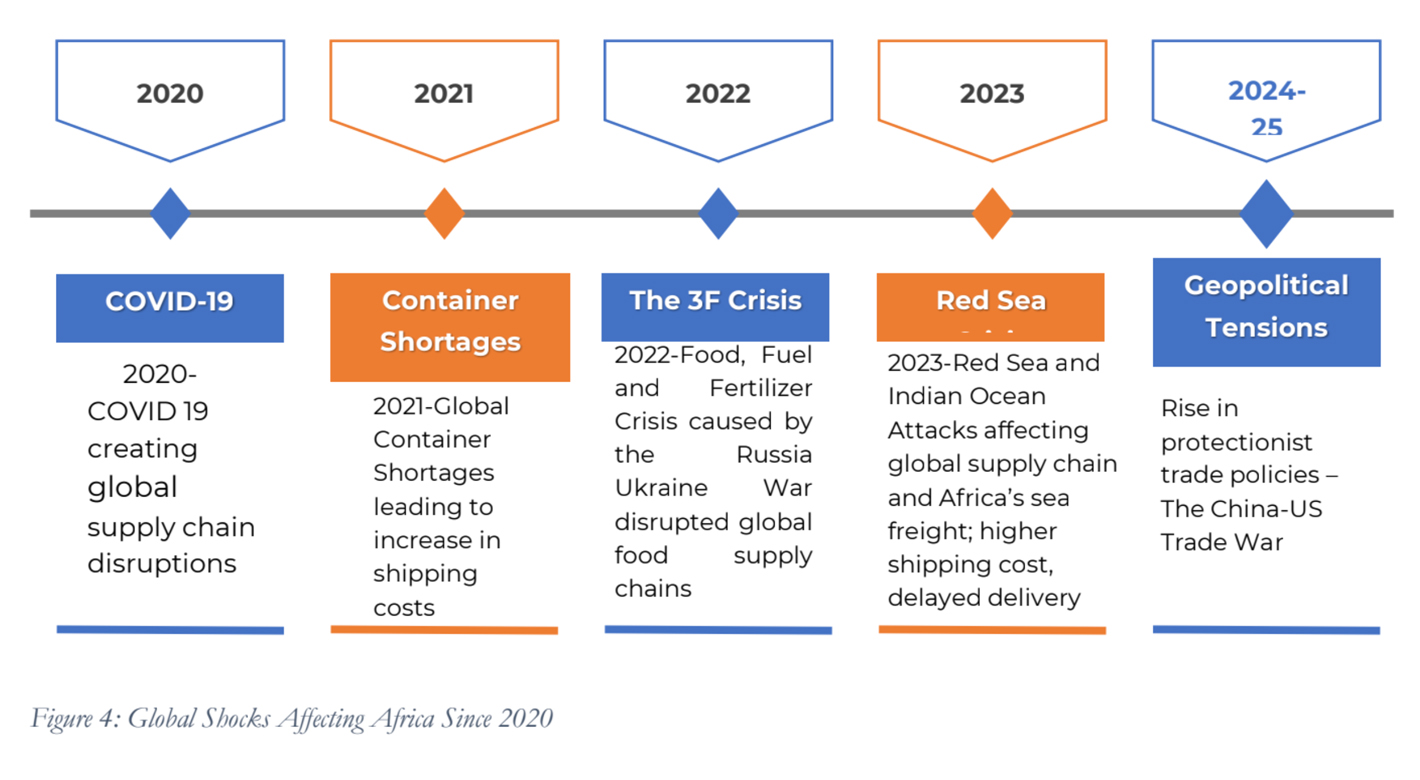

Africa as a continent has not escaped the disruptions and complexities of global trade. Major sequence of events that have adversely affected the continent include geopolitical tensions, trade wars and trade policies of major markets like the EU and US. Beginning in 2020, the COVID-19 pandemic led to a disruption in global supply chain which only did not affect Africa but the world at large, however as a result of disruptions in supply chains, Africa could not access critical vaccines and associated products to fight the pandemic. The global shortages of containers in 2021 triggered an increase in shipping costs and delivery time while as a result of the of the Russia-Ukraine War in 2022, Africa faced the three ‘F’ challenges: Food, Fuel and Fertilizer crisis resulting in food price hikes and imported inflation. In 2023, attacks from the Houthis on shipping vessels on the Red Sea and Indian Ocean affected Africa’s Sea freight with higher shipping cost and delayed delivery. Lastly, the rise of trade protectionist policies by major developed and industrialized economies and the tariff wars escalation only portrays the more complicated.

D. Impact of Global Trade Challenges on Africa

The complexities outlined earlier affected African countries significantly and in different ways. First, the global economic shocks have precipitated a marked deceleration in Africa’s economic performance. Average real gross domestic product (GDP) growth slowed from 4.1 percent in 2022 to 3.2% in 2023, representing a significant deterioration from historical growth projections. This decline follows an already subdued average growth rate of 2.4% between 2011 and 2024, demonstrating the continent’s persistent struggle with external vulnerabilities.16 Africa’s merchandise trade growth rate contracted sharply from 15.93% in 2022 to 6.3% in 2023, despite earlier positive momentum reflecting this broader economic malaise. Each dramatic deceleration underscores the continent’s susceptibility to global demand and supply chain disruptions stemming from multiple international crises.

Second, the cumulative effect of successive global shocks has exacerbated Africa’s debt sustainability challenges. The 2008 Global Financial Crisis, COVID-19 pandemic, and the war in Ukraine have collectively constrained the region’s growth potential while simultaneously increasing borrowing requirements. Public debt levels have stabilized but remain above pre- pandemic levels, with nine countries in debt distress and eleven at high risk of distress. The aggregated debt-to-GDP ratio reached approximately 68.6% of GDP in 2023, with the debt burden increasing by 1.3 percentage points between 2022 and 2023.17 This, in no doubt worsens the vulnerability of African economies which further threatens long-term development objectives of the continent. Nearly half of African nations maintained their debt-to-GDP ratios above 60% in 2023, with many allocating greater resources to debt interest payments than to critical social sectors such as education or health.18 This fiscal constraint limits governments’ capacity to implement countercyclical policies during economic downturns, thereby amplifying the adverse effects of global shocks on domestic economies.

Third, the resurgence of trade nationalism has introduced additional headwinds for African economies. The rise of protectionist policies culminated in April 2025 when the United States imposed a 10% baseline tariff on all imports from 57 countries (20 from Africa). Lesotho in Southern Africa had the highest tariff of 50% on its imports to the US, with about eight other countries in Africa having tariffs of 30% or higher.19 This policy shift effectively dismantled duty-free access under the African Growth and Opportunity Act (AGOA), directly undermining established trade relationships and market access arrangements to the US market for African countries. These protectionist measures have consequently generated significant disruptions to global supply chains, substantially increasing import costs for essential commodities including fuel and food. The resulting current account deficits have led to depleting foreign reserves and increasingly expensive debt servicing obligations, further constraining fiscal space across the continent.

E. How Africa is Turning Challenges into Opportunities

Africa countries have already turned some of these complexities into opportunities. First, the COVID-19 seemed to have spurred Africa’s adoption of e-commerce at unprecedented levels. The pandemic and its associated lockdown and other control measures drove African consumers to online marketplaces and platforms for shopping. A study in 2021 revealed that 40 percent of African consumers intended to maintain their shopping from pre-pandemic levels or increase them.20 Consumer adoption of e-commerce platforms have contributed to the increased utilization of digital and mobile payments, development of apps and e-commerce platforms. Between 40-60% of businesses in Africa adopted digital strategies during the COVID pandemic and afterwards the digital platforms have sustained business-to-business and business-to consumer relations.21 Africa e-commerce is projected to reach $180 billion in 2025, up from $115 billion in 2015 driven by e-commerce, increasing youth population, expanding digital public infrastructure, and access to new technologies22.

Second, the global supply chains disruptions saw Africa focusing on driving development of transport networks and economic corridors as crucial for seamless connectivity within the continent. Road transport carry about 80% of goods on the continent.23 Between 2004 and 2022, the African Development Bank allocated over $13 billion to finance regional road corridor projects, focused on 25 priority corridors across the continent comprising over 18,000km of road networks and 27 one-stop border posts, aimed at facilitating cross-border trade on the continent.24 These efforts lower logistical costs, improve trade accessibility, and boost intra-regional commerce.

Third, Africa has leveraged global trade complexities to accelerate the implementation of the African Continental Free Trade Area (AfCFTA) agreement. Launched in 2019 and operational since 2021, AfCFTA creates a single market for goods and services across 54 African Union member states. With a combined GDP exceeding $3.4 trillion and a population of 1.4 billion, this framework fosters trade liberalization, reduces barriers, and strengthens Africa’s position in global markets. The AfCFTA has seen 49 ratifications by State Parties and about 3000 certificates of origin issued as of March 2025 by participating countries compared to 13 issued in 2022.25 The AfCFTA piloted the Guided Trade Initiative that saw seven state parties of the AfCFTA pilot trade under the agreement and has since seen interest from other state parties to utilize the continental preferential trade agreement.

F. How African Economies and Businesses Navigate Global Trade Complexities

To navigate these complexities, African governments and businesses should adopt multi-faceted strategies. For African businesses, a suggestion will be to consider identifying and developing supply chains on the African continent leveraging on the AfCFTA. Businesses can utilize the AfCFTA to develop shorter supply chains-sourcing raw materials and inputs by involving fewer intermediaries and therefore reducing supply chain complexities. This strategy will also mean a diversification from traditional sources of import and export of raw, semi-finished and finished products by businesses on the continent from traditional trade partners such as EU and U.S.

The AfCFTA presents a great opportunity that African businesses can cultivate. Though relatively new in implementation, it is important that African governments and businesses on the continent move swiftly to utilize and benefit from the agreement as major and traditional markets like the US and EU are gradually becoming difficult to access. The EU through its Green Deal has introduced unilateral non-tariff measures again the import of major African exports-cocoa, coffee, soy, mango and rubber from deforested and degraded forests. Also, the EU Carbon Adjustment Mechanism will also limit access to the EU products with high carbon intensity from Africa. For the US, the wide-ranging tariff increases is expected to affect African countries who utilize AGOA for access to the US market. Hence, the continental market in Africa, based on the AfCFTA seems a plausible and more relevant alternative to supply the continents’ 1.4bn people- a huge internal market-forecasted to be the second most populous continent by 2030. Additionally, Africa can develop new trade relations with countries in the Middle East, Turkey, India and China (which has recently offered zero duties to imports from a number of African countries).

Complementing economic diversification, African governments can create an enabling environment for businesses by increasing investment in transport, energy, and digital infrastructure. Upgrading such infrastructure will lower trade costs, improve production logistics, strengthen connectivity within and outside the continent and increase Africa’s resilience. As a strategic response, Africa should prioritize cross-border infrastructure under AfCFTA, integrate value chains, and leverage digital platforms to boost intra-African trade and attract investment amid shifting global trade dynamics. This will help to facilitate smoother cross-border movement of goods, reduce costs of supporting regional integration efforts and enhance the competitiveness to mitigate the growing challenges.

Enhancing digital trade offers immense potential for Africa’s economic transformation. Investing in emerging technologies such as AI, blockchain, and global trade management software enhances operational efficiency, ensures compliance with trade regulations, and boosts e-commerce adoption. As digital platforms reshape international trade dynamics, African businesses must leverage these innovations to remain competitive. Specifically, African businesses should leverage on the use of e-commerce platforms, mobile payments and digital marketing to reach markets and improve efficiency.

Finally, in general, capacity building is considered a fundamental pillar when considering the ways in which African businesses can enhance their capabilities to mitigate global trade complexities. Capacity building in training and skills development, trade policy understanding and negotiation skills will equip African businesses with skills, knowledge, and tools to adapt to shifting trade patterns, interpret and influence trade agreements, meet standards, and be able to compete globally. Singles out, investing in training and upskilling personnel will enable businesses and policymakers to navigate complex regulations and technological advancements. Purposefully, African businesses should invest in training on trade rules, digital tools, and financial management, leverage public-private partnerships for knowledge transfer and funding and tap into regional programs under AfCFTA, RECs, and development partners.